ITALY, TUSCANY, PISA, VOLTERRA

Luxury Restored Farm with 98 Hectares near Volterra

DRONE:

Just 20 minutes from the beautiful Etruscan hilltop town of Volterra and 1 hour from the coast, this prestigious property is surrounded by unspoiled countryside, in a hillside position with a dominant view, in a place where time seems to have stopped.

The farm is accessed via a 5 km unpaved road in perfect condition. The closest restaurant is 6 km by car, in a little ancient hilltop village.

The current owner bought the property in 2013 when it was a ruin and has restored it to an extremely high standard, mixing the old style of the authentic farmhouse with modern interior design and technology.

The farm comprises 98 hectares of land, which is mostly arable land and pasture with 600 olive trees, some fruit trees and ponds for irrigation.

The house is in the middle of the land, in a dominant position and accessible via an automatic gate.

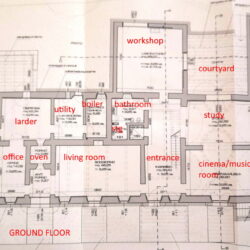

It is a 730 sqm building (net floor area) on two storeys, a real gem, and consists of:

an amazing central hallway, an impressive living room with wooden panelled walls, giving a charming and warm atmosphere to the room, like an old medieval castle, a huge open plan kitchen-dining-room and pantry, industrial design and a fully equipped kitchen and wood burning oven, laundry and boiler room.

On the other side of the hallway is a large sitting-area/cinema room, characterised by amazing cross-vaulted ceilings, (this room was originally the old stable of the property), a bathroom, elevator leading to the first floor, 2 enormous bedrooms with en-suite bathrooms, and a large workshop/studio with bathroom.

All rooms have large French doors facing the garden around the villa, which provide lots of light to the rooms and feeling of continuity between the outdoor and indoor space.

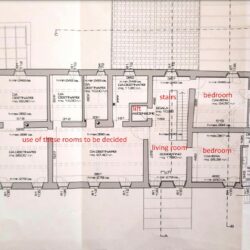

The first floor is accessible via both an external and internal staircase, as well as with the lift for disabled people. The first floor has been partially renovated and it comprises 3 huge bedrooms with en-suite bathrooms, whilst 180 sqm have been left unfinished – 6 large rooms which can be renovated as additional bedrooms with en-suite bathrooms, or it would be even possible to create a second apartment.

The villa has been properly insulated, the outside walls are 1 metres thick and the heating system is underfloor with heat pumps, and is controlled by home automation technology.

The owners have installed a 19.5 kw photovoltaic system on the roof of the nearby storage building.

All windows are double glazed and with safety glass, the floors are in resin or with very large tiles and the vaulted ceilings boast amazing old terracotta tiles.

The lawn is perfectly irrigated and there are several well-tended fruit trees.

The house has private water springs and therefore is not connected to the water mains. It is self-efficient, sustainable.

The property is completed by a 270 sqm storage building for agricultural equipment, tractors and garden tools.

There is a beautiful infinity, salt and heated water swimming pool which allows swimming also during the winter. The sundeck is in travertine stone and the automatic cover allows the pool to be used all year round.

This is a real jewel, a fantastic place far from the noise and the chaotic life of the city, immersed in the gentle rolling hills of Tuscany, where every day you can admire different scenery and colours.

View all our properties on our website casatuscany.com