ITALY, TUSCANY, SIENA, SINALUNGA

Prestigious Hilltop Estate For Sale

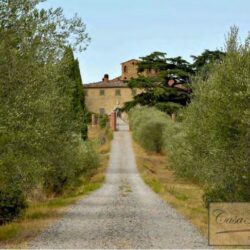

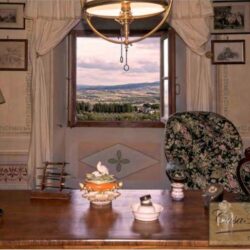

This prestigious hilltop estate is located in the municipality of Sinalunga on a panoramic hill (430 metres above sea level) from which you can admire the nearby historic centre of Sinalunga and the Val di Chiana and even as far as Amiata.

The complex is located in the centre of a large agricultural estate of about 63 hectares of land consisting of about 13 hectares of olive groves, about 10 hectares of vineyards and about 40 hectares of woods, pasture and arable land.

As is often the case for architecture dating from between the end of the 17th and the beginning of the 18th century, the property has increasingly taken on the appearance of a stately country residence.

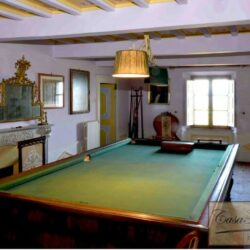

The complex of buildings consists of a main villa and five other buildings, used as homes, a private chapel and annexes, making up a total gross area of approx. 2,250 sqm.

In the courtyard behind the main building is a beautiful swimming pool with a changing room and relative technical facilities.

Due to its characteristics, this impressive hilltop complex lends itself to multiple activities, from agricultural to tourism or simply residential.

The property is easily accessible, given the nearby road connections (Valdichiana exit of the A1 located about 10km away and the Due Mari highway is about 5km away).

This attractive property isn’t far from renowned tourist centres such as Siena (about 50km), Arezzo ( about 35km) and Florence (about 100km) as well as close proximity to the Umbrian territory (Perugia is located about 65km. Orvieto at 70km), as well as the possibility of reaching Rome in less than 2 hours. The complex is definitely one of a kind.

Layout (880 sqm):

Ground Floor:

9 rooms including:

Cellar

Boiler room

Hallways

Storage rooms

First Floor:

9 rooms including:

Kitchen

Hallway

Store rooms

3 bathrooms

Second Floor:

10 rooms including:

Corridors

Storage room

3 bathrooms

Third Floor:

Attic with 8 rooms

Fourth Floor (roof terrace):

3 attic rooms

Annexes:

1) Building arranged partly on 2 and partly on 3 floors above ground, consisting of 2 residential units and 2 units used as warehouses and deposits for agricultural activities. The first of the 2 houses is on 2 floors, ground and first, and consists, on the ground floor of 3 cellar rooms, hallway, closets and oven, and on the first floor of 3 rooms, kitchen, hallways, cupboards, bathroom and terrace. The second is arranged on 3 floors above ground and comprises, on the ground floor entrance, cellar and closet, on the first floor, a kitchen, closets and corridors, and on the second floor, two rooms, hallway, closet and bathroom. The total gross commercial area of the property is approx. 370 sqm (3983 sqf) regards the housing part, and of approx. 270 sqm (2906 sqf) for the part used as warehouses and deposits.

2) Building on 2 floors above ground, consisting of 3 residential units: the first unit is located on the ground floor and consists of 3 rooms, kitchen, hallway, 2 bathrooms, shed and exclusive appurtenant courtyard in front. Second unit, is located on the first floor and consists of an external staircase, porch, 4 rooms, kitchen, hallway and 2 bathrooms as well as an exclusive appurtenant courtyard. Third unit is on 2 floors and is composed on the ground floor; a kitchen, hallways, cupboards and bathroom, as well as a small mezzanine area above the bathroom, and on the first floor, accessible by an internal staircase, from a room, closet, hallway and bathroom. The total gross commercial area of the property is approx. 390 sqm (4198 sqf).

3) Small church – a building arranged on a single floor above ground and consists of a main room used as a chapel, with access from the courtyard of the villa and from three rooms behind it. The total gross commercial area of the property is approx. 100. sqm (1076 sqf).

4) Accessory building adjacent to the church, consisting of a small building, arranged on a single floor above ground and composed of 2 real estate units, each consisting of a room used as a garage. The total gross commercial area of the property is approx. 65 sqm (700 sqf).

5) Accessory building adjacent to the garden of the villa. It consists of a small building, arranged on a single floor above ground, located downstream (east side) of the fencing wall of the villa’s garden and consisting of a single room used as a garage. The total gross commercial area of the property is approx. 50 sqm (538 sqf).

External areas:

Approximately 63 hectares (156 acres) consisting of approximately 12 hectares (30 acres) of olive groves, 10 hectares (25 acres) of vineyards and 40 hectares (99 acres) of woods, pastures and arable land.

The vineyard is made up of the prized Sangiovese, Canaiolo, Trebbiano and Malvasia varieties and is registered in the DOCG Chianti Colli Senesi; the grapes have recently been transferred to the Montepulciano winery.

The olive grove consisting mainly of the Leccino, Moraiolo and Frantoio varieties for exposure and optimal height produces an oil of excellent quality.

The wood is made up of typical Tuscan essences and in particular of the different varieties of oaks (downy oak, turkey oak and holm oak).

Swimming pool with changing room and relative technical room.

Parking area and garage.

Gravel road: 450m.

Distance from services: 1.5km.

Distance from main airports: Perugia 77km | Florence 119km | Rome 221km.

Utilities: Phone line | Wi-Fi | Autonomous heating | Mains water + electricity

Energy Efficiency Rating: G

View all our properties on our website casatuscany.com